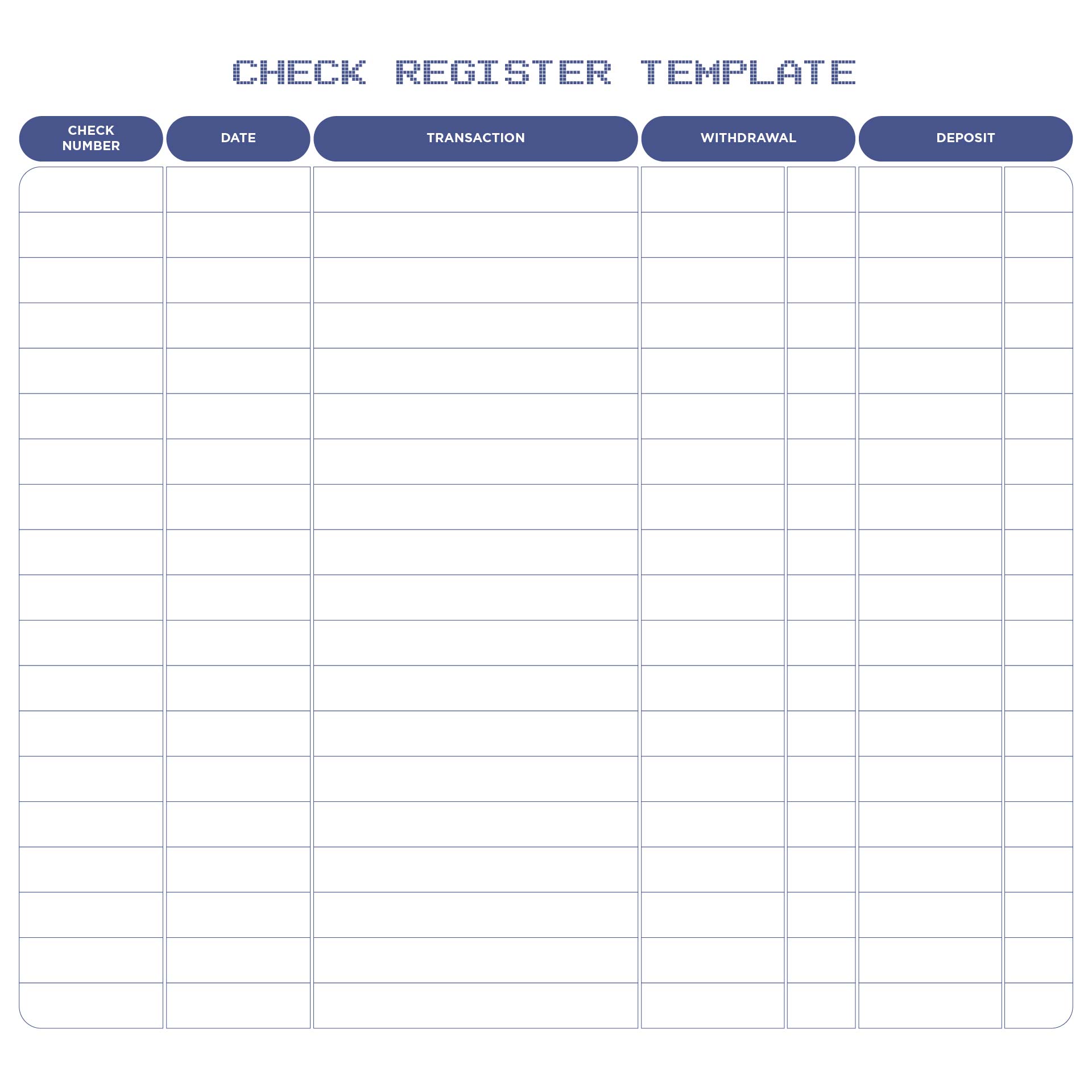

#Printing checkbook registers pdf#

PDF editor permits you to help make changes to your Printable Check Register from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently. Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.After the form is fully gone, media Completed.Place an electronic digital unique in your Printable Check Register by using Sign Device.Navigate to Support area when you have questions or perhaps handle our Assistance team.Very carefully confirm the content of the form as well as grammar along with punctuational.Make sure that you enter correct details and numbers throughout suitable areas.Use your indications to submit established track record areas.On the site with all the document, click on Begin immediately along with complete for the editor.

#Printing checkbook registers how to#

Stick to the fast guide to do Printable Check Register, steer clear of blunders along with furnish it in a timely manner: How to complete any Printable Check Register online: He can be reached at 83.Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Most banks have user-friendly websites and will be happy to set you up with this service.īarry Dolowich is a certified public accountant and owner of a full-service accounting and tax practice with offices in Monterey. In addition to reconciling your bank account, it is also a good idea to periodically review your account online for any unusual charges or transactions. Failure to timely reconcile your bank accounts can cost you money! If you do discover a bank error, report it to the bank immediately and be sure to follow up the correction. Please note that on occasion banks do make errors, or you could be the victim of identity or check theft. After a few months, you will become an expert at reconciling your checkbook and enjoy the satisfaction and peace of mind of knowing that you have an accurate balance. Most bank statements provide a reconciliation format as described above to help guide you through this process. The resulting total should equal the balance of your checkbook register. To balance, you need to subtract the outstanding checks and add the outstanding deposits to the ENDING bank statement balance. Once you have the above information, you are ready to reconcile your checkbook register balance to the bank statement balance. These are deposits you made that have not been credited to your account as of the ending date of the bank statement. You will also need to make a list of any outstanding deposits. These are checks that you have written, but have not been charged by the bank as of the ending date of the bank statement. You will need to make a list and total all outstanding checks.

You may need to enter legitimate receipts or charges (i.e., interest income, bank charges and fees, etc.) in your register.

To do this, you will need to “check” off all the items (deposits and withdrawals) in your check register that appear on the bank statement.

The idea is to compare your checkbook register with the bank statement to be sure each entry is accurate and that the arithmetic is correct.

0 kommentar(er)

0 kommentar(er)